The retirement process

It’s important to know what information you will receive and when, and the steps you will need to take.

Retirement statements

You will receive a retirement statement each year. You can also request a full retirement quotation and generate your own illustrative quotation at any time.

Annual statement cycle

Each year, you will receive a short retirement statement showing:

- the value of your retirement options from the Fund, and

- an up-to-date transfer value of your Fund benefits.

Your statement will also include login details to the Aon Retirement Options Modeller so that you can explore your options in more detail.

Take the first step . . .

Read your statement and consider your options. If you have a statement from last year, you might want to compare it with your latest one to see how your benefit quotations have changed.

Explore your options . . .

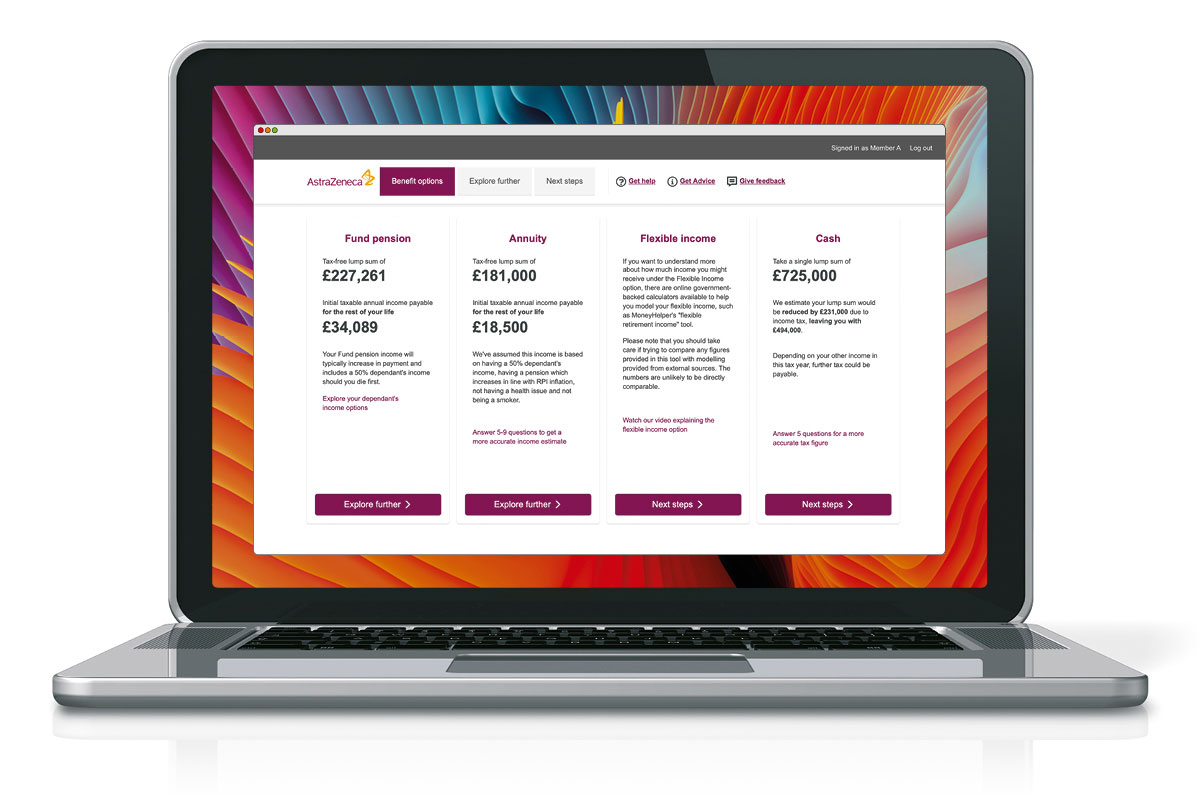

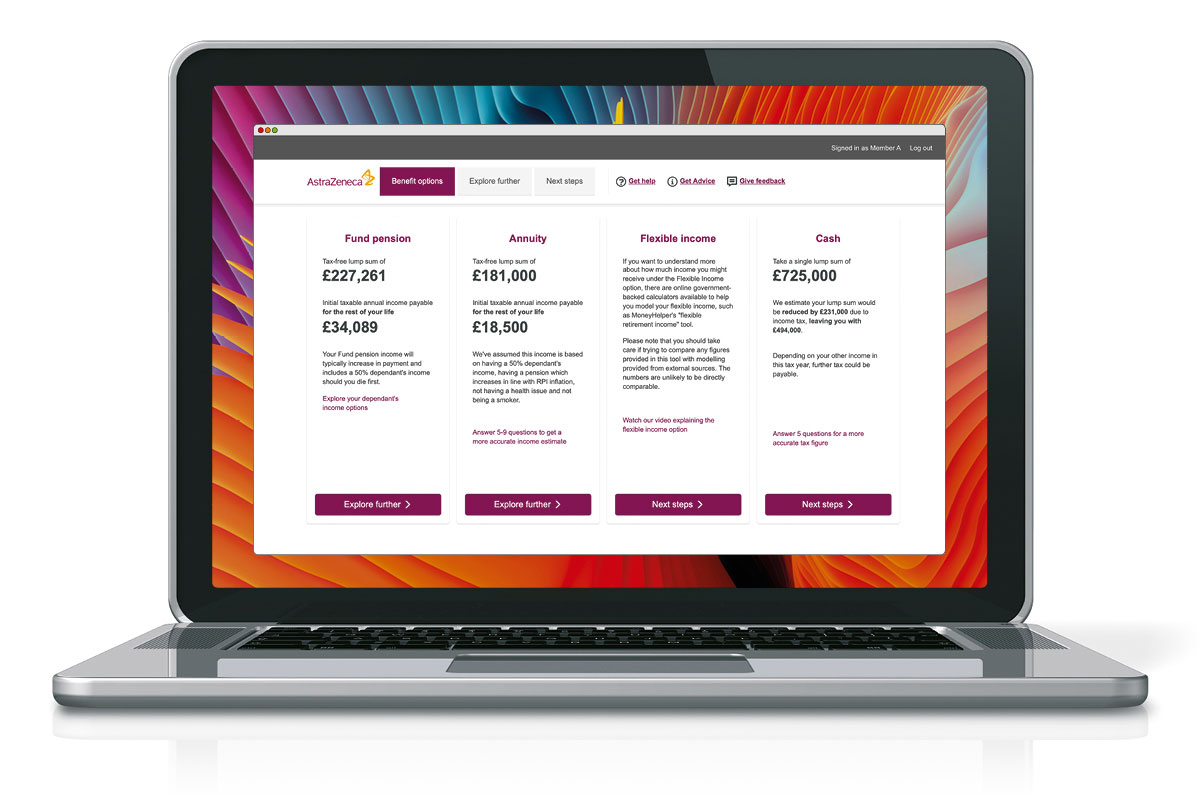

This powerful, easy-to-use tool will be pre-loaded with the value of your Fund benefits enabling you to see the potential income each retirement option could provide you with.

It also explains your options and signposts other useful resources.

Go to the More online page for more detail and to access the tool.

Your login details will be on your last annual statement (if you received one) and your retirement pack. If you need help, please contact the Pensions Team.

Get advice . . .

The Company will pay for you to receive up to two sessions of financial advice from Wren Sterling.

They will give you a personal recommendation and help you complete the necessary forms if you decide to transfer out of the Fund.

See the Financial advice page for more detail.

Financial advice

If you are interested in transferring out your Retirement Account and its value is £30,000 or more, you must take impartial financial advice.

Remember: the Company will pay for you to receive up to two sessions of financial advice from Wren Sterling.

To find out more, go to the Advice page.

Outside of the annual statement cycle

Outside of the annual cycle, you can request a full retirement quotation at any time by contacting the Pensions Team.

You are entitled to three retirement quotations in any 12-month period.

Take the first step . . .

Review the figures in your previous statement (if applicable) and on the Aon Retirement Options Modeller.

The figures on the modeller will be illustrative at this stage but will still help you to explore and consider your options.

Go to More Online to access to the tool.

Your login details will be on your last annual statement (if you received one) and your retirement pack. If you need help, please contact the Pensions Team.

Request updated figures . . .

If you want your figures updated, request a new retirement quotation by contacting the Pensions Team.

You will receive a retirement pack which will include:

- personalised figures of the immediate income you can expect to receive from the Fund,

- a summary of the retirement process,

- a reminder of how you can explore your options using the Aon Retirement Options Modeller, and

- how you can get paid-for independent financial advice on your options.

See Your retirement pack for more details.

Get advice . . .

The Company will pay for you to receive up to two sessions of financial advice from Wren Sterling.

They will give you a personal recommendation and help you complete the necessary forms if you decide to transfer out of the Fund.

See the Financial advice page for more detail.

Self-service statements

At any time, you can use ePensions to generate a retirement and transfer value quotation.

Figures are illustrative only.

You will need to request a retirement pack to get a guaranteed quotation. This will also update your figures in the Aon Retirement Options Modeller.

My AZ Pension

My AZ Pension can help you in a number of ways:

- View and, in some instances, change the data we hold for you.

- Run your own retirement and transfer value quotations.

- If you have an Investment Account, you can find out your latest fund value in real time, and make investment changes.

Go to More Online for access to the My AZ Pension website.

Remember!

You can start to take your benefits at any time, subject to your minimum retirement age.

There is no obligation to start taking your benefits on receipt of your annual retirement statement, a full retirement pack, or having taken advice from Wren Sterling.

Ultimately it is your decision how and when you take your benefits.

Making your decision

However you decide to take your Fund benefits, if you take paid-for financial advice from Wren Sterling, they will help you to complete the necessary forms.

You can download the forms from the ePensions site - access is from the More Online page.

Forms to be completed

You will need to complete and send in the following forms by email or post:

- your decision form

- an identity check form

- a bank details form

- a pension tax form

Other documents

You will also need to send in the following documents by email or post (unless stated otherwise):

- your original birth certificate for you, and your spouse or civil partner (if applicable), and

- your original marriage certificate (if applicable), and

- a copy of the photo page of your current passport, and

- any divorce or death certificate.

Plus

If you live overseas, you'll need to provide copies of two utility bills from the past three months.

Forms to be completed

You will need to complete and send in the following forms by email or post:

- transfer agreement form

- identity check form

- declaration form

Other documents

You will also need to send in:

- your Advice Statement (from Wren Sterling or your own choice of adviser)

- a Financial Advice declaration form (completed by Wren Sterling or your own choice of adviser)

- a copy of the photo page of your current passport

Plus

If you live overseas, you will need to send in:

- your original birth certificate

- two utility bills from the past three months

What will be in your retirement pack?

You now know what you will receive and what you can request as part of the retirement process. Let's take a look at what will be in Your retirement pack when you receive it.